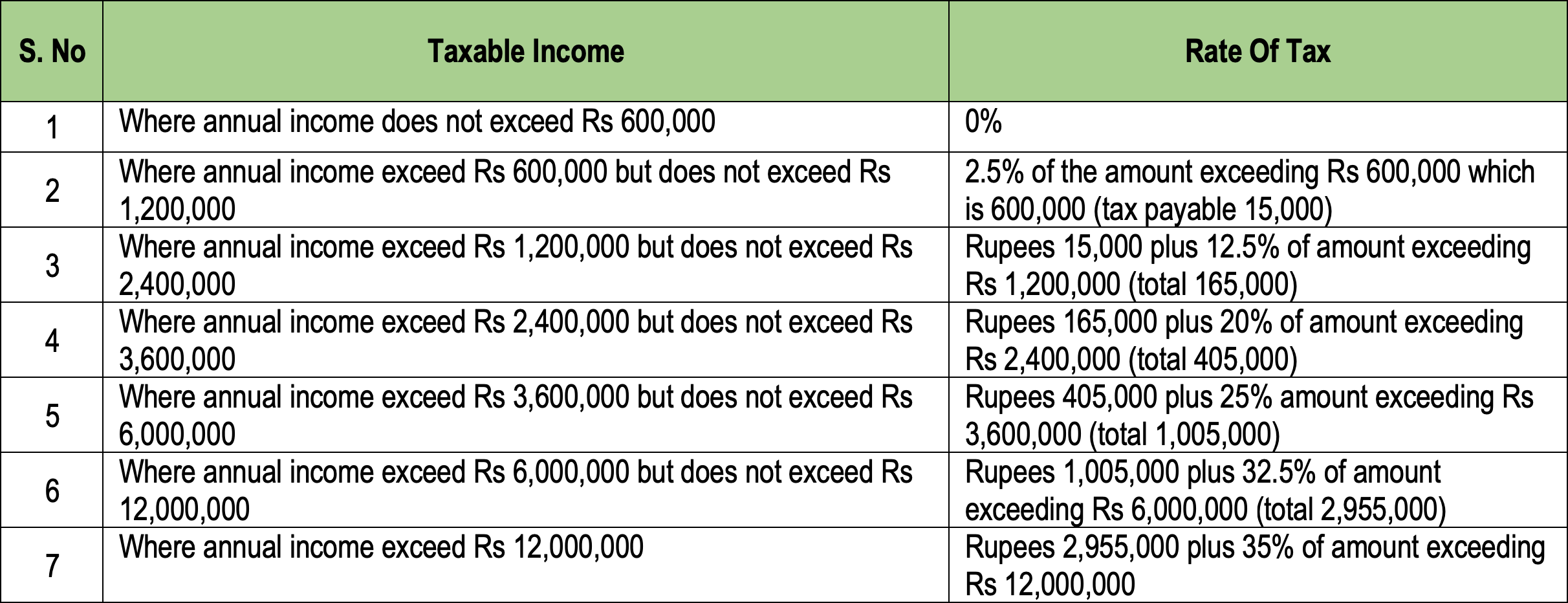

The tax that you pay on your income. Income Tax is paid by wage earners i.e., salaried class, self-employed and non-incorporated firms. Income Tax is one of the important sources through which a government finances its activities.

Types of taxes on immovable property:

- Withholding Tax or Advance Tax (Both by Seller & Purchaser)

- CGT (Capital gain tax) (By Seller Only)

- CVT (Capital value tax) (CVT for urban area only, rural are exempted) (By Purchaser Only)

- Stamp Duty (By Purchaser Only)

Withholding Tax or Advance Tax (both are same) (Adjustable):

WHT is known to be an ‘advance tax’, which means it acts as an advance on other taxes and, hence can be adjusted into other tax liabilities.

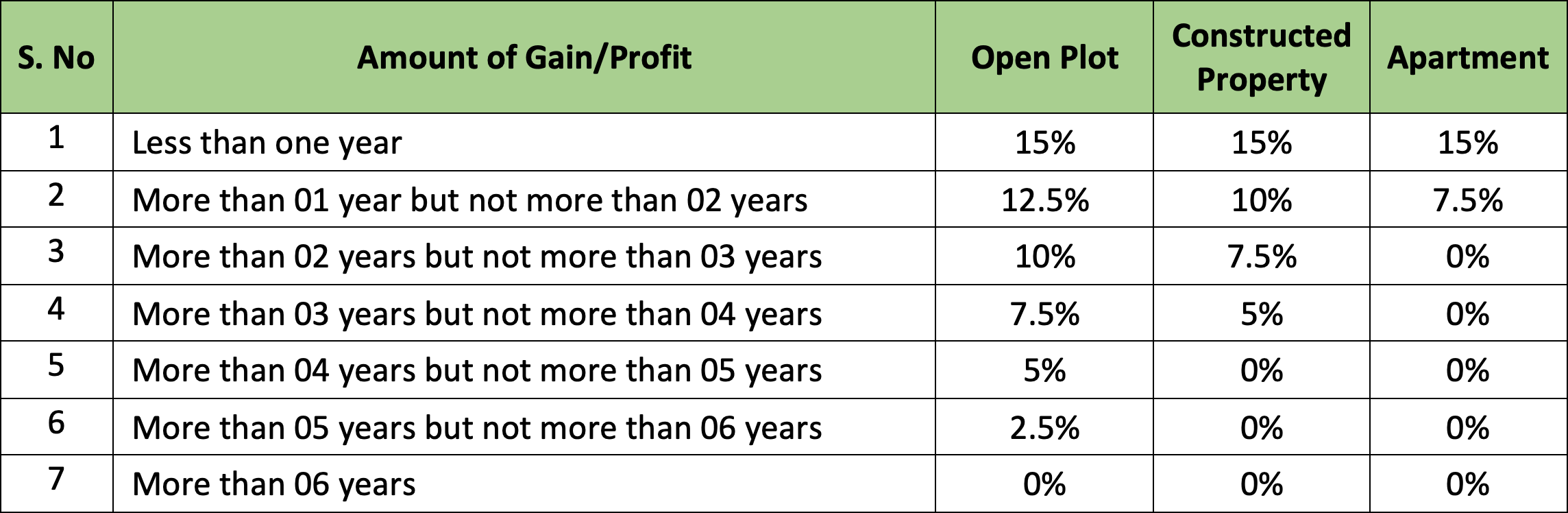

CGT (Capital gain tax) (Not adjustable):

Capital Gains Tax (CGT) is a federal tax to be paid by the seller. When the seller makes profits on selling property (capital asset), it is the profit (capital gain) which is taxed, hence the name. These gains are to be calculated according to the fair market value, based on FBR’s valuation table.

Capital Value Tax (CVT) & Stamp Duty: (By Purchaser Only):

Capital Value Tax (CVT) is a provincial tax and is paid by the buyer at the time of buying property. As the name suggests, it is payable on the capital value of an acquired asset

Property that is transferred as a gift, an exchange or relinquishing the rights on a property all come under Capital Value Tax. However, transfer of property between parents, spouse or any of your blood relatives either as a gift or through inheritance have been excluded. In cases where it is a gift or exchange, or where property value is not mentioned in the transaction the value of the property is calculated according to the values determined through the valuation tables.

- They are paid as per DC rates and not FBR Value of your property

- CVT at 2% of DC Rates.

- Stamp Duty at 3 % of DC Rates

- ICT area is exempted from CVT, on the time of sale purchase of immovable property in ICT the seller and buyer tax which they pay as 2% as filer and 5% as non-filer is advance tax not CVT

- In ICT area we pay stamp duty in different shapes on different stamp papers

- These are direct taxes on your property and are not adjusted or refunded in annual tax returns

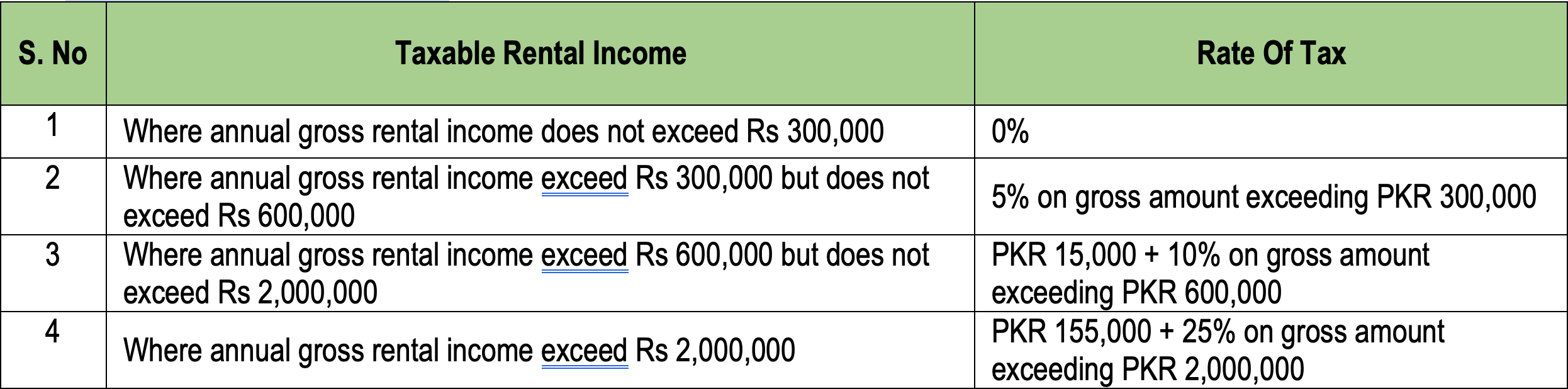

Tax Slab On Rental Income:

Tax imposed on deemed income from immovable properties:

A tax rate at 1% of 5% of fair market value of any asset has been imposed on deemed income from immovable properties through a new section introduced to Income Tax Ordinance, 2001.

The government announced federal budget 2022/2023 on June 10, 2022 and introduced new tax on a person having more than one immovable property. A person having more than one immovable property which values above Rs25 million shall be treated as five per cent of rental income of fair market value

A resident person shall be treated to have received rent equal to five percent of the fair market value of an immoveable property situated in Pakistan whether such property has actually been rented out for any consideration or not.

This section shall not apply to:

(a) One self-owned immovable property;

(b) Self-owned business premises from which business is carried out;

(c) Self-owned agriculture land where agriculture activity is carried out by person but does not include farmhouse and land annexed thereto;

(d) Where the fair market value of the property or properties, in aggregate, excluding properties mentioned in clauses (a), (b) and (c) does not exceed twenty-five million Rupees;

(e) A Provincial Government, a Local Government, a local authority or a development authority;

(f) Land development and construction projects of builders and developers registered with Directorate General of Designated Non-Financial Businesses and Professions of Board;

(g) A property which is subject to tax under section 15 of the Ordinance and the tax chargeable is more than tax chargeable under this section:

Provided that if tax chargeable under section 15 is less than the tax chargeable under this section so much of the amount of tax which is in excess of tax chargeable under section 15 shall be paid under this section.

The Federal Government may include or exclude any person or property for the purpose of this section.

![$blog_data[0]->title](https://villasystem.landandvillas.com/public/backend/assets/blog_images/Blog-635cea6e9e8a1-taxes.jpg)