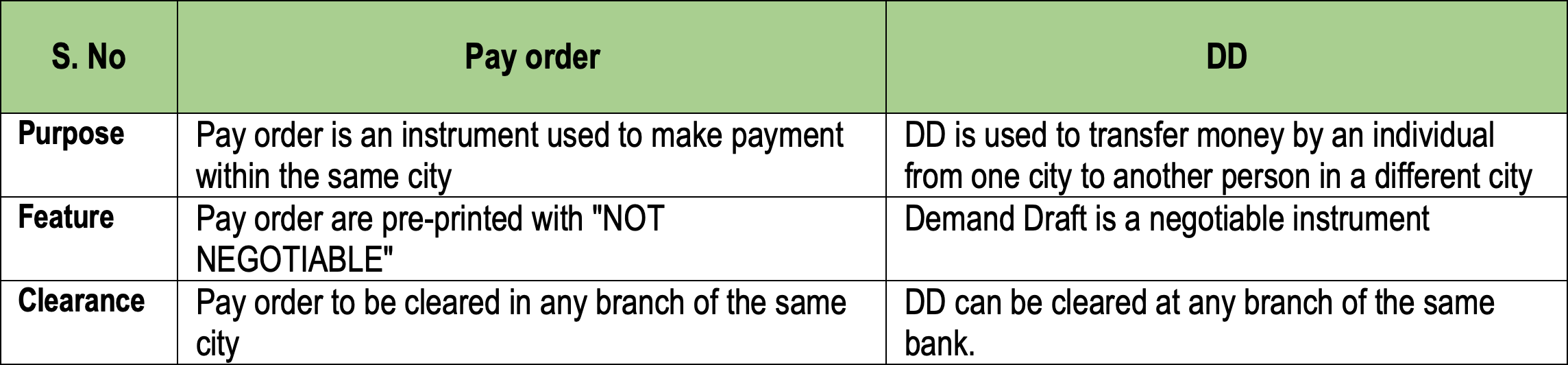

Demand Draft is a prepaid Negotiable Instrument, wherein the drawee bank acts as guarantor to make payment in full when the instrument is presented. DD cannot be dishonoured as the amount is paid beforehand. Demand draft is usually used to make payment outside a city. Demand Draft can be cleared at any branch of the same bank. A demand draft of value Rs 20,000 or more can be issued only with A/c payee crossing.

Pay Order or Banker's Cheque:

The payment order is a financial instrument issued by the bank on behalf of customer stating an order to pay a specified amount to a specified person within the same city. In payment order is pre-printed with the word "Not Negotiable”. There is no chance of dishonouring as the amount is prepaid. Once issued Pay order will be valid for 3 months.

Cheques:

Checks validity in Pakistan is 6 months from issue date

The payee is the one who receives that sum. The drawer is the party that obliges the drawee to pay the payee

How to make/fill cheque:

- Better to avoid any transactions through cheque because it may bounce due to insufficient funds or due to mistake in signatures or cheque issuer can stop the payment, always use pay order for all transactions

- Always keep a copy of issued cheque and better to make an agreement by writing the details of drawer and payee/beneficiary, check details and purpose of check issued

- When filling cheque always write date and month in 2 digits if it’s in one digit always add zero before this, for example 09-08-2021

- In “Pay” and “or bearer” area while writing name never leave any space at start always write name near to word “Pay”, after writing name if space left at the end better to draw a line up to “or bearer” words and do the same in “Rupees” and “PKR” area, always write word “only” after writing amount in words and add /- after writing amount in “PKR” area

- If cheque is issued on the name of any person always strike off the words “or bearer” if it’s not stricken off and check lost anyone holding the cheque can use it

- Try to issue cross cheque always and strike off the word “or bearer” it will protect you

- Cheque issued for any other person holder will sign on front side of cheque only, no signatures at back and payee/receiver will sign at back side of the cheque on the time of presenting cheque in bank

- In cheque at bottom the written digits show “check number then bank and branch code then account number and at the end 000” is currency code

![$blog_data[0]->title](https://villasystem.landandvillas.com/public/backend/assets/blog_images/Blog-635d0d07cdcf0-CHECK.jpg)